As a Georgia personal injury attorney, I am handling more and more Uber and Lyft accident cases. You see people using Uber and Lyft every day in a busy city like Atlanta. These types of car accidents are quite common now, especially in comparison to just a few years ago in Georgia. One of the first questions I will get asked in my Georgia personal injury practice is: “What should I do if I’ve been hurt in one of these types of accidents?”

I’m here to help, but first, let me offer a bit of background…

Do you know that the Chicago University Business School determined — “The arrival of ridesharing is associated with an increase of 2-3% in the number of motor vehicle fatalities and fatal accidents”? The percent may seem small at first glance. But, it’s actually quite a lot considering the sheer number of automobile accidents already happening in Georgia. While Uber and Lyft’s services provide a lot of benefits to people, there are several reasons why Uber & Lyft drivers may be more likely to cause a car accident in places like Atlanta, Georgia:

Next, you need to know about Uber and Lyfts’ insurance policies after an automobile accident.

When it comes to rideshare service in Georgia, things are a little bit different: When it comes to your Uber & Lyft driver, their own personal insurance companies, such as State Farm, GEICO, and Allstate, will not be willing to compensate you for your personal injuries in a car wreck. Why is that? Well, most insurance companies will include in their policy that the insurance only covers “personal use” and thus will not include business activities, like driving for Uber and Lyft. Fortunately, Uber and Lyft have their own insurance policies for their drivers.

A quick point of comparison: In a non-rideshare traffic accident in Georgia, a passenger can get compensation for bodily injuries directly from the insurance company of the other driver. FYI — If there’s not enough coverage, i.e. money available, the passenger might also be able to get reimbursement from their own insurance company and the insurance company of the owner’s vehicle. It’s still though probably less than the coverage for Uber and Lyft drivers.

Let’s look at the fine print for these types of accidents…

For Uber’s insurance following an accident with personal injuries, Uber provides the following insurance policy for its driver:

As for Lyft, their insurance policy states that for an automobile accident:

Our primary liability insurance is designed to act as the primary coverage from the time you accept a ride request until the time the ride has ended in the app. The policy has a $1,000,000 per accident limit.

What’s this mean? As a practical matter, there’s not really a difference between the amount of insurance coverage after an accident in Georgia involving Lyft. Good news, you don’t have to choose Lyft over Uber or vice versa for this reason. 😉 Insurance questions may be complicated after an accident in Georgia so feel free to ask me. Always here to help!

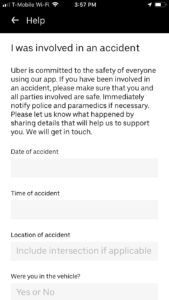

Image of Help Feature on Uber App to Report an Automobile Accident

We know that being hurt in an accident is always hard for people. But at least the reporting process for Uber and Lyft is pretty easy:

As with other automobile accident cases, you may be entitled to

If you are involved in an Uber or Lyft accident and have more questions about the Georgia personal injury process, please feel free to call me today.

Get Your Free Consultation Today

required fields *